I get asked many times what the costs are for buying a property in Spain. When buying a Spanish property there are both costs for the buyer and seller. However, there are uncertainties as to which costs belong to the buyer and which to the seller.

There is no fixed fee when it comes to selling a property in Spain as there are many factors that influence the amount of taxes to pay.

Generally speaking in Spain on average the buyer will end up paying around 12%-14% on fees and taxes and the seller around 23% on the profit made from selling the property.

Costs for buying a property in Spain

- Property Transfer Tax

(between 4%-11%) - Notary fees

(between 600-1000 euros) - Property registry costs

(400-650 euros) - Gestoría costs

(between 250-500 euros) - Property valuation costs

(only if a bank mortgage is needed normally around 800 euros)

For newly built properties

- IVA or VAT

- (10%)

- IAJD

- (between 0.5%-1.5%)

Costs for selling a property in Spain

- Agency commission

(between 3%-6%) - Capital gains tax

(variable 19%,21%,23% for 2020) - Income Tax Provision (Retención

(3% non-residents only) - Energy certificate

(between 100-500 euros) - Plusvalía

Notary fees (Buyer)

These are the costs for drawing up the deeds in Spain called the “Escritura”. In general, Spanish law states that these costs should be distributed by the signing parties, meaning that the sellers should take care of the original costs of the deeds “escritura” and the buyer for the copies. However, Nowadays it is normal that the buyer pays for all these costs.

Notary fees are based on the selling price stated in the deeds of the property. As an example, you pay around 675 euros for a property of 100.000 euros. But for a property of 1 million, you might have to pay 1000 euros. To search for a Spanish notary in your area, visit the Spanish Notarial Guide.

Property registry costs (Buyer)

It is normally a standard fee also based on the selling price in the deeds. These costs may vary depending on the municipality you live in and in most cases, it is between 400 and 650 euros.

Gestoría (Buyer)

This is an optional cost. A gestoría is like a bookkeeper that handles tax payments and paperwork to formalize the deeds of the property and mortgages.

Solicitors can also handle all paperwork and normally charge around 1% of the selling price.

Property transfer tax (Buyer)

When buying a second-hand property, the buyer has to pay the property transfer tax. For newly built properties, the buyer pays instead VAT or IVA of 10%.

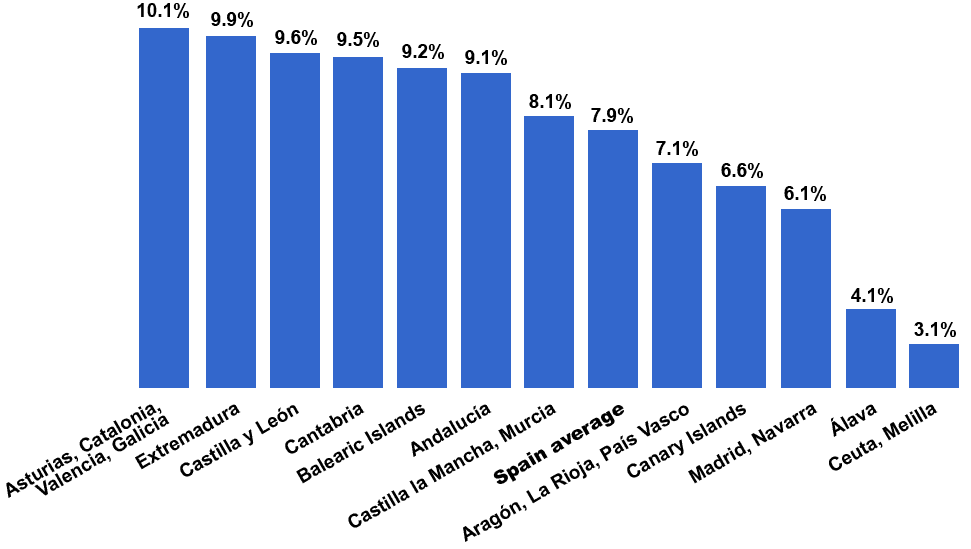

The property transfer tax is a tax that varies from region to region

In Valencia, Catalonia, and Galicia region, the property transfer tax is 10%.

In the Balearics, it is 8% for properties under 400.000 euros, 9% for properties between 400.000 and 600.000 euros and 10% for properties of more than 600.000 euros.

In Andalucía you pay between 8% and 10%, and in the Canary Islands 6.5%

Almost every year the Spanish government changes the cadastral value for each municipality, which has a direct effect of the Property transfer tax and Plusvalía tax.

Property valuation costs (Buyer)

In case a buyer needs a mortgage, the bank has to make a valuation of the property. In this case, the buyer will pay around 800 euros for this appraisal.

For newly built properties (Buyer)

When buying a newly built property directly from the developer you pay IVA or VAT of 10% instead of paying the normal property transfer tax. On top of that, you also pay a Tax on documented legal acts or IAJD in Spanish

Agency Commission (Seller)

When you sell a property through an estate agent you will have to pay a commission fee. Estate agents usually charge around 5% commission in Spain. The seller can deduct the Agency commission fee from his capitals gains tax.

As a seller, you might want to ask the services the agency provides. Good estate agents should also have the legal know-how to make option contracts, apply for NIE numbers, and after-sales services like changing the utility bills and community charges to the new owner for example.

Sellers can advertise their property through several estate agents. Nevertheless, some estate agents will want to offer the seller to sell it exclusively through them by agreeing to take a smaller commission fee.

Did you know that it takes an average of more than 8 months to sell a property in Spain?

Sellers need to take that into account when advertising their property exclusively through an estate agent.

Capital gains tax (Seller)

19% for the first 6.000 euros

21% from 6.000 and 50.000 euros

23% from 50.000 onwards

As an example if the seller bought a house in 2003 for 200.000 euros and in 2018 he sells it for 350.000 euros, he will have to pay capital gains over 150.000 euros in this way:

(350.000 – 200.000 = 150.000). 19% for the first 6.000 (6.000 x 0.19) + (50.000 x 0.21) + (94.000 x 0.23)= 1.140 + 10.500 + 21.620= 33.260 euros.

There are exceptions when the seller does not have to pay capital gains tax and that is when the sellers of the property are older than 65 and have lived there officially for at least the last 3 years.

All official invoices relating to the purchase of the property, such as refurbishing, notary expenses, lawyer expenses, and estate agency fees can be deducted from the capital gains tax.

Income Tax Provision for non-residents – Retención (Seller)

If the seller is not a Spanish resident he has to pay a 3% income tax provision or retención in Spanish which goes directly to the tax office to cover any taxes resulting from the sale. However, the seller can claim for a refund if he believes that his tax liability is less than 3%.

Energy certificate (Seller)

From June 1, 2013, by Spanish law all property owners who want to sell or rent out their property need an energy certificate. These certificates must be issued by a qualified certifier, such as architects, surveyors or technical house engineers. The costs for such a certificate may vary on the size of the property and can be between 100 and 500 euros. The invoice for this certificate can also be deducted from the capital gains tax.

Plusvalía (Seller)

The plusvalía is a tax over the increase of the value of the ground the property is on. This is paid to the local town hall. The plusvalía is calculated on the basis of 3 factors: The period of ownership, the location of the property and the cadastral ground value.

The plusvalía tax can easily be requested at the town hall where the property is located.

By law, the plusvalía tax should be paid by the seller and it can be a substantial sum of money. Nevertheless, the plusvalía can be paid by the buyer if he has agreed to it.

View example of a Plusvalía (.pdf)

Here is a basic example giving some rough estimates of the costs:

Mr. A (the seller) sold his apartment in Mallorca to Mr. B (the buyer). When Mr. A bought the apartment in 2003 he paid 200.000 euros. Now Mr. A has managed to sell the apartment in 2020 to Mr. B for 350.000 euros.

If you want to sell your home in Spain, you might also be interested to read about these tips for selling your property in Spain FAST.

Costs for the seller (Mr. A)

| Sold it in 2020 | 350.000 |

| Bought it 2003 | – 200.000 |

| Profit before taxes | 150.000 |

| Capital gains | – 33.260 |

| Agency fee 5% | – 17.500 |

| Income Tax Provision 3% | – 10.500 |

| Plusvalía tax | – 4.000 |

| Energy certificate | – 300 |

| Net profit | 84.440 |

Costs for the buyer (Mr. B)

| Purchase price | 350.000 |

| Property transfer tax 8% | 28.000 |

| Notary fee | 800 |

| Registry costs | 600 |

| Gestoría | 400 |

| Total Costs | 379.800 |

FAQ on buying and selling property in Spain

Q: My wife and myself both over 65 and Spanish residents. We sold our house feb2019 which we had lived in over 15 years. We bought an apartment in March 2019. no capital gains should be involved? We do not like living in the apartment and want to sell . Purchase price 140000 selling price maybe 150000 euro we know we may have some capital gains to pay. My question if we buy a static caravan on Residential Park Site near Antequera 39000 euro monthly community fee 370 euro. Will this be classed as buying another home avoiding the retention fee.

Regards Trevor

A: Dear Trevor,

We are not totally sure we understand your question about the retention. In the sense that if you are both over 65 years old and you are both Spanish residents (meaning that you are submitting tax returns as tax residents here in Spain), no capital gain tax will accrue on the sale and no retention (we refer to the non-resident 3% retention) will apply to the sale as you are tax residents here.

Q: Greetings from Malaga, I am 69 and my wife is 55 years old and we both are Spanish residents. We lived in our house for 22 years and we are now selling our house. Am I exempt from paying capital gains tax for only half the selling value and responsible for paying tax on the other half because my wife is not 65 yet? Thanks in advance.

A: Dear Greg,

Your assumption is correct; in the sense that the gain related to the share of the co-owner who is older than 65 years old would be exempt without the need for reinvesting in another main home.

However, this rule applies only to the main home and therefore to tax residents in Spain.

Therefore, without further information, we would suggest that your share would be exempt if the property is your main home and provided that you have been Tax resident in Spain, meaning that you have been submitting taxes here as residents.

Your wife may benefit from the exemption in the event that she reinvested in another main home within 2 years.

Q: We are thinking of selling our holiday house in Costa del Sol which we bought 5 years ago and paid €356.000. We got an offer from a real estate agent who has a client who wants the house and will pay €785.000. From my calculations,we would need to pay CGT of €97.500? If I understand it correctly then we can deduct the Agency fee (5% Selling fee) of 47.500 and our refurbish costs of €24.000 from this amount so the “real” CGT will be apartment €25.000. Is this correct? We are non-residents in Spain. Thank you in advance.

A: Dear Martin,

Regarding your question, please note that capital gain tax payable by non-residents when selling a property in Spain is calculated by applying 19% to the gain obtained from the sale.

Said gain is calculated on the difference between the acquisition price (price paid for the property plus all the taxes and costs involved) and the sale price less all the taxes and costs involved (the real estate agent’s fees, the Municipal Plusvalia Tax and Lawyer’s fees can be considered for calculation purposes).

Please note that not all types of refurbishes costs can be taken into consideration for this purpose. The pertinent items and invoices should be carefully analyzed to avoid possible tax inspections and associated sanctions.

In any case, you have to note that at the time of completing the sale before the Notary, the buyer is obliged to withhold 3% of the price and to pay it to the Tax Office on account of the possible capital gain tax of the sellers. This is recoverable by the seller following satisfactory proof that the full amount of CGT and any other taxes due have been paid.

Q: we are currently trying to buy a small house in Spain, we’ve signed an offer form with an estate agent which was accepted, the estate agent contacted our solicitor to write up a contract, we paid a deposit to the solicitor’s account and vendors withdrew from the sale before signing the deposit contract. Our solicitor wants to charge us 50% of his legal fees even though deposit contract was not signed and there was no sale, should this fee be paid for by estate agents as they essentially sold us a house that was not for sale at all and they are acting for the vendors who have no solicitors?.

A: What a bummer. I really feel sorry for you. The solicitor should be compensated for the work he/she has done, but 50% seems a little unreasonable. However, there is not a set fee or minimum price by law for that. You have 2 options:

1) Bargain the amount of 50% to 20% for example

2) Start a lawsuit and try to get your money back, which might take a long time and money.

Q: Hi! I overheard someone talking about a new rule in Spain which is that the bank now is the one paying notary fees and other costs when buying a property in the country. Is that really true?

A: That is only true for the mortgage costs if a mortgage is needed. The taxation of the property is still to be paid by the buyer when buying with a mortgage.

Q: We are in the process of purchasing a property in Spain. We have paid the deposit and everything appears to be going through. We are living in England and paying the price in pounds to an English Bank as the sellers are English. We agreed on on a price at euro rate to the pound some months ago, but this has now fallen. However, we have just been sent a list of legal retentions that must be paid by the sellers. However, this long list -Spanish capital gains, plusvalia, estate agent pending fees, pool declaration costs is being added up and converted from euros to pounds and we are expected to deduct this off the sellers selling price for the property and transfer the money to Spain in euros. The fall in the pound, plus transfer fees is going to cost us a lot of extra money. Is this right? The solicitor says it is Spanish Law but we don’t see why we should settle this when it is not our responsibility. Your guidance on this would be helpful

A: The exchange rate should be the rate on the day of the purchase to avoid further discussions about this.

Alternatively, you can also agree on a fixed purchase price, that is up to you.

The sellers should be liable to pay the plusvalía, CGT, agent fees and pool declaration. That is not something you should pay for.

The buyer pays the price the transfer tax, notary fees, registry costs, and your bookkeeper/solicitor.

Q: Hi. We sold our mother’s house on 6th June 2019. It was left in a will. The solicitor told us it was sold but now we cant get in contact with him. We have tried calling, emailing, WhatsApp but no response. What should we do next?

A: You will need to go to the notary in Spain to get things started.

The notary will advise you what to do and what papers you need.

This will also save you a lot of time and money if you do it yourself.

The papers you will need are:

1) NIE number of the deceased person(s) (your mother) and from the persons who are inheriting. To apply for NIE numbers you will need your passports, so don’t forget that.

NIE number is a ID number for foreigners.

2) You will also need an “aceptación de Herencia”, which is a paper that states that you accept the inheritance.

3) You will also probably need a bank extract of your mother’s bank account of the last 2 years.

4) IBIs of the house. Which is the property tax receipts (you can get that at the town hall, ask the notary how you could get it)

5) Escritura (deeds of the house)

6) Declaración de herederos (Declaration of heirs)

7) Testamento (the will)

Declaración de la Renta (Statement of income of your mother)

In any case, go first to the notary and ask where to start. You can search here for a notary close to you http://www.notariado.org

You can also go to a gestoría, which is the Spanish word for a bookkeeper.

Q: How long does it take for seller to receive money after completion of sale?

A: In most cases, the money is received at completion. However, international bank transfers might take 3-4 days to complete, and in some cases, banks can retain the funds for 1 week or so.

Q: Hello, We bought a villa in 1999. We paid (showing clearly on our escritura) Euros 180,000 and Plus Valia Euros 60,000. So we actually paid euros 240,000 approximately. Now in 2019 we are selling at gross euros 340,000.

Please – will capital gains (profit) tax be levied on us at 100,000 or 150,000? Namely, our cost for current tax liability purposes was 180K or 240K? At present we’re not getting a clear answer to this from the notary.

A: That is a very odd situation since normally the plusvalia is paid by the seller. The amount of 60,000 sounds too high to be the plusvalía anyway since it is 33% of the price. Do you have a receipt for this 60k payment? In a normal situation, taxes are usually calculated from the amount presented in the escritura.

From reading the first page of the deeds, it says that all the costs arising from the sale are to be paid by the buyer except the Plusvalia which is for the seller. Having concluded that, the 60K is not the plusvalia, then it must be another payment.

Do you remember if you paid this amount in cash? It also can be a downpayment you made or b money. I say this because I know that up to 5 years ago it used to be a regular practice to pay amounts in B to avoid paying extra taxes.

It also can be that the estate agents or intermediary took this 60k and declared only a selling price of 180K, which regrettably also happens quite often. In that case the seller only got 180k and could have been unaware that you paid 240K. Anyway, see if you can find the official receipt for the 60k.

Q: Hi, I’m currently doing a 5-year rent to buy. We’ve agreed on a value that’s in black and white for 135.000€ and by the time the 5 years is up would have paid a 1/3 off, leaving us to pay 90.000€. At the time of signing, how does it work that we would have already paid off 45.000€, in terms of fees needing to be paid etc etc? Do we just agree between seller and buyer that the house is being bought for 95.000€ or ‘declare the agreed price of 135.000’ what are the pros and cons of either. Thanks in advance.

A: In this case, you have 2 options:

1) Create a private contract between you and the seller where you agree to pay the rent/ installments of 1/3 of the property.

This is risky because in the meantime the seller can mortgage the property and you can be left with a property that has debt on it.

2) Go to the notary and have a proper selling contract drafted, which is fairest for both you and the seller. In the contract, I would declare the full 135.000 euro and provide the details on how the installments are being paid.

Q: My Spanish solicitor is charging 2000euros for our Spanish purchase and says it’s not refundable if sale falls through. Is this correct? Also, am I correct in assuming the buyer pays no estate agent fees?

A: It is indeed correct for the solicitor to charge you 2000 euros. The solicitor acts on your behalf and has to check if what you are buying is in order and maybe negotiate some points with the seller or the other solicitor. For example, if the property is furnished there might be an inventory list etc and a portion of the selling price can be allocated to furniture in order to pay fewer taxes for example…The solicitor also has to calculate expenses prepare the option contract, etc…. So it is only reasonable your solicitor charges you 2000 euros. On the downside, solicitors can be very strict and can discuss endlessly with the other party which can create irritations and eventually the sale might fall through. I have seen that happen many times, so my advice is to be fair and not play hardball if you really want the property, since nowadays it is a seller’s market. With regards to the payment of the commission, it is indeed so that in 95% of the cases the buyer does not pay commission. There are some exceptions in some regions in Spain (Castellón and Valencia) where it is becoming increasingly popular that the buyer also pays half of the commission. But as a general rule, it is the seller that pays for the agents’ commission and so it happens that many sellers want to sell their property privately or maybe use an online agent that charges a fixed commission fee.

Q: Hi, We live in Mallorca in a house purchased by my husband 11 years ago. He is non-resident, works overseas for more than 6 months of the year. This is our main home. What tax implications when selling? Its value approx €1,400,000 purchased for €735,000. Looking to purchase a cheaper house around €300,000. Thank you

A: You would have to pay quite a lot of Capital Gains tax since you made quite a lot of profit. Depending on which municipality you probably also have to pay quite a lot of municipal plusvalía.

Here is a rough estimation of the costs:

Capital gains tax around = 152.000 euro

Municipal plusvalía estimate = 10.000 euro

Agency commission 5% = 70.000 euro (not compulsory if you sell it privately)

Lawyer 1% = 14.000 euro

Retención 3% = 42.000 euros

Other = 1000 euro

Total costs = 289.000 euros when selling at 1.400.000 euro

Of course, you can deduct many expenses to reduce your costs, such as building costs, agency commission, lawyer, etc…

Q: I am a resident of the USA and live in California. My mother who was born and raised in Spain passed away recently. In her will, she transferred ownership of a piece of property she owned to my brothers and I. We are now on title for the property and we want to sell it to a family member in Spain or list it on the open market (we want to do this remotely and not have to come up to Spain for this transaction). We want to understand what the market value is for the property so we think the best way forward is to get a fair market value opinion from 2 to 3 agents who work in that part of Spain. Once we have a number for the fair market value we can then discuss a purchase price with our cousin or we may decide to list it on the open market. What is the best way to start this process? And do you think we need more than one opinion from a real estate agent as to what the fair market value is? If we decide to sell to our family member we will, of course, save quite a bit on the commissions so if we decide to go that route I am assuming that all we would need is an attorney to help with the transaction? Gracias!

A: Sorry to hear about your mother. I would not use an estate agent to have the property appraised since the market price they quote might be unreliable. A good starting point would be to look at similar listings in for example idealista.com, which is the zillow/ trulia of Spain. You can also use an appraisal company such as TINSA to get a more accurate market value.

You can just indeed use an attorney to handle the sale since selling a property in Spain is not that straightforward as it is in the US.

Q: We bought a property for 120k euros in 2003 and are now selling at 85k! However we used a Portuguese lady as our power of attorney and are horrified that on our deeds it’s states we bought the property for 40k euros! So we will have to pay a large amount even though we have lost money! Is there anything we can do about this? We believe the lady went to prison! Thanks, Sandy

A: Sadly enough you cannot undo what the selling amount is in the escritura of 2003, since you signed for it by power of attorney. If you are a little lucky, you might have received a “complementaria” fine after having have bought the property in 2003 for the ridiculous escritura amount of 40k euros. Normally the Spanish tax office would give the property a higher selling valuation and sends out fine for it, which would decrease the amount you have to pay for CGT. I presume this has not happened and thus you will probably need to pay around 11k euros only on CGT if you sell at 85k.

Make sure to gather any official invoices on any costs incurred related to the property, e.g.: reforms, notary expenses, registry costs, estate agent commissions, solicitor fees, etc….since you will be able to deduct these completely.

Q: Hello, my 66-year-old mum bought an apartment in Mallorca 20 months ago and has refurbished it. The community has now decided to renovate the building and are demanding the sum of €380 per month for the next 18 months. My mum has no savings and lives on a pension of £600 a month. She feels forced to sell as she has no savings and struggles to manage on the £600, however she has been warned to wait 3 years or she will be taxed heavily. Are there any other options for her? Thank you in advance

A: I am sorry to hear about your mum´s situation that is really bad news for her.

Normally in each community, there are meetings where these things are discussed and it is advisable to go to these.

My advice would be to talk to the president of the community or administrator and explain the situation.

If that does help, you could gather signatures from other owners in the community that are against the €380 increase and present these to the community administrator.

It would also be good to know for what reason/purposes are they going to renovate the building. There is a difference between a “necessary reform”, like some kind of structural damage or a purely aesthetic reform, which could be considered as an optional reform. I have just read that according to Legalitas, one of Spain’s most prominent Legal advisory firms, the majority (60%) of the building owners have to agree for an “optional reform” to go through.

Q: Hi there, in your article you do not mention that the buyer also has to pay Estate agency fee. However this is the case in Valencia, where both the Buyer AND the Seller typically pay 3% commission fee. Would you be able to explain in what areas of Spain they follow similar practice? Thank you

A: Charging the buyer is not a common practice in Spain and many foreign buyers are led to believe otherwise. It is the seller that pays the commission from the money that was paid for the sale of the property.

In most cases, the agent will receive a check with his/her commission at the notary when the deeds are signed. However, sometimes the agent can receive a portion of their commission when signing the option contract for their assurance should the sale fall through. Anyway, there is no set rule of law as to which percentage and who is eligible to pay the agent’s commission in Spain.

As you mention, I have also read that some and/or many estate agents in Valencia and Castellón (not in Alicante/Costa Blanca) are charging both the buyer and sellers, which in my opinion can be deceiving for the buyer if he/she has not been informed previously, since that is not the case for all other provinces in Spain. Charging commissions for both buyers and sellers is frequently done in Valencia and Castellón for lease/rentals agreements and it seems it is a practice that is also being used when selling a property as you are pointing out, but I am not certain if this is customary. So my advice would be to make sure you know about the commission distributionand percentage in advance before dealing with any agent and preferably have that in writing to avoid any surprises.

Standard commission fees in Spain can vary quite a lot but and are normally between 3% up to 6% by some agents in coastal regions.

In Madrid, the normal commission fee is 3%. However, in the Costa del Sol, Costa Blanca and Mallorca, for example, the standard commission is 5%.

Q: I bought a house in Martos for €19,000 in 2014 and sold it at a loss for €14,000 last summer. To date I have only received €10,000. The agents fees were €2,000. The estate agent was Derryl from Undiscovered Spain and her partner Diego. I have asked for paperwork but have received nothing so far and they are becoming elusive, what can I do? Is there a law that ensures I should have a copy of all paperwork?

A: Thank you for your question.

Since you did not make any profit you probably do not have to pay CGT.

I imagine estate agents’ argument is that the 2000 euros is probably meant to cover any taxes on your behalf (3% retención). The Spanish tax office often takes its time to give you back the money left after paying all taxes.

My worry is that there is a big discrepancy between the 3% that should have been held back to pay your taxes,280 euros, and the actual 2000 euros allocated.

I would go to the notary (make sure to take your ID/passport and NIE number) where the sale was completed and ask for a copy of the deeds to see for what price the property was sold for and ask them to advise you on the procedure to take in these cases.

Ask also for any other copies of the papers related to the sale. Hopefully, you also have the invoice of the 2000 euro commission and any other paper that can give you a clue as to where the other 1720 euros are.

Were you there at the notary when the sale was completed? or did you give a power of attorney to the estate agent?. I say that because I have seen cases where the estate agent had sold the property for a different price and has kept the difference. I am not saying this is the case, but it has happened before.

You can also find out directly from the buyer what price they actually paid for since it seems quite odd that you paid 19.000 euros in 2014 and after the crisis last year you sold it for only 14.000 euros.

You will probably have to go to the town hall and tax office to find exactly what has happened and if your taxes have already been paid or not, what was the exact amount that was paid and when do you expect to get any refunds and how much it is.

Q: Hello, I have noticed that a lot of Spanish people sell their houses privately and their ‘for sale’ signs just have a personal phone number. Presumably, this is to avoid those astronomical fees. You advised in a previous post that “a proper agent will give you an invoice for selling your property, which you can use to deduct from your capital gains tax” but apart from this, the advertising, and showing people around, is there anything you are gaining from not selling privately? If you are happy to advertise and show people around yourself, (and surely your solicitor would deal with the invoices for CGT calculations anyway?) then I am wondering why I would give an agent at least 5% of the sale price! If it was 1%, then fair enough! Thank you.

A: You certainly have a point there.

You can do both, sell privately and through 1 or more agents, why not.

You can, for example, try to sell it privately first for a couple of months and then decide to go through an agent.

I would advise, however, to quote the same price for all clients, even if they come through an agent.

Why? because it is not professional to the client to have different prices with or without an agent and that might confuse the client and scare him off.

It is also not fair for the agent to have your property listed for a lower price privately and is not a motivating factor for them either and your goal is ultimately to sell the property.

Some agents might also have a client database that they can ring up to see if they are interested in your property and that is a good thing since it increases your chances of selling it.

Q: Dear Robert, Thank you for your excellent answers. Now we have a question. We are thinking of selling our apartment in Malaga province. We bought the property in 1984 for approx 40000 euros and the selling price is now 160000 . We want to buy a property in Torremolinos (reinvest) for the same amount. However, if we have to pay CGT it means we can only afford to buy a property of approx 120000 euro. which will impair our living standards considerably. Is there anything we can do to be exempt from the CGT Our situation Sole owner – a permanent address in DK Owner since 1984 non-resident living in Spain for just under 6 months a year. Chronic health issues improved by Spanish weather conditions. Is it correctly understood from your previous answer that if I reinvest I can be exempt of CGT.? Kind Regards Ulf

A: I am afraid you will still have to pay CGT since the property in Spain is not your primary residence.

On top of that, if the reinvested amount is less than the total amount received in the transfer, only the proportional part of the capital gain obtained that corresponds to the amount reinvested will be excluded from taxation. But this only in case your property in Spain is your primary residence.

Q: Hi We are moving back to the UK due to my husbands’ health. We own our own property which we completed the purchase on the 2nd July 2015 for 151,000.00 euro (including fees and taxes). We are selling the apartment for 225,000.00 euros (before commission). We will then be investing all the funds into a property in the UK although it may not be straight away as we need to find something. Please could you advise if we would need to pay Capital Gains Tax and how it works. We have heard that we won’t have to pay any because we are buying in the EU but that the notary takes it anyway and then you have to fight to get it back which could take 2 yrs!! On our calculations it would be about 10 grand which we would not be lost should we not be able to get it back (knowing Spain!) If this is the case I suppose it would be better to wait until after 2nd July to sell? Your advice on this matter would be greatly appreciated. I should mention we are tax residents.

A: I would definitely wait after 2nd July to sell your property. Anyway, you can already advertise it and start to make the arrangments to move back to the UK, since selling your property might take longer than expected. But I would recommend, if you find a buyer, to have the completion signed after the 2nd of July.

I assume the property you own in Spain is your primary residence and you both are owners and are above 65. If that is the case you do not need to pay CGT if you sell after 3 years, and you will only have to pay the municipal plusvalia, the estate agent and solicitor if you have any.

Q: I would like to sell my house in Tenerife, It was bought by my mother in 1992 for 6 million pesetas, and we lived there as a family until her death in 2008 when I inherited the house. The deeds were changed over to my name and the property was valued at 60.000€. In the deeds at this time an increase in value of 90,000€ due to improvments and the inclusion of an old finca house, was added and we paid the tax on this amount. This then gives the new total value to be 150.000. I am a spanish resident and tax registered, but what I’m wondering is how much Capital gains I’m likely to have to pay, is it calculated from when the house was bought by my mother, or from when I inherited it? resale value is approximately around the 250,000€ mark. I will certainly buy a new property, but would probably only invest half of the sale amount, and may possibly not live in it for over three years. Any help would be appreciated.

A: Inheriting a property is much like buying a property when it comes to paying CGT. In your case you will have to pay CGT from the moment you inherited the property since all taxes were already paid when you inherited the property. I am a little bit confused as to how another property, in this case and old finca, could be added to the deeds. I imagine it was an old ruin on the premises which was reformed. If you say the property is now valued at 150k and you sell it for 250k, then you will have to pay CGT over 100k, which would be if I’m not mistaken 21.760 euros. You might only be able to deduct half of that if you are planning to reinvest by buying another property that is half the value of your sold property. Please bear in mind I’m just giving estimates on the data that is at hand and I would advise you to consult a Spanish solicitor or gestoría to conduct a more accurate calculation.

Q: We are both well over 65 and wish to sell our villa which we have lived in for 12years, and return to UK to buy a property to live in would there be any problem transferring to money to UK

A: When you sell your house in Spain you will have to pay your taxes in Spain and next year you will have to do your income tax declaration in Spain.

You can transfer the money to your bank account in the UK, but for the tax declaration, you will have to declare your UK bank account.

When transferring the money to the UK it is also a good idea to see what exchange rate your bank is charging, it is sometimes a smart move to use a currency broker to transfer your funds to the UK since that can also save you thousands of pounds.

Q: Hi, is it legal for a buyer to claim for maintenance costs after the sale has completed? We sold a property in Spain last September, the buyers had a walk through to see how everything worked five days before completion and at the time I showed them how the aircon worked and it was working fine. Now they are claiming over €1000 for the air conditioning which they say was not working properly when they moved in – are they entitled to do that, please?

A: Just a quick reply to your question. In Spain when you buy a house it is wysiwyg (what you see is what you get). The airconditioning is not even part of the physical structure of the house and it is not possible to claim form any damages. Only in some extreme cases would the buyer be able to claim for structural construction damages, eg: buildings affected by aluminosis (the degeneration of cement used in construction). Rest assured that they will also not spend money on a solicitor for 1000 euros and it is only a scare tactic. So the best thing you can do is ignore it.

Q: One thing that has stunned us is the estate agency fees, compared to the UK which I know for a fact are very very low, mainly because of online sales,( our eldest son works in this field) but even so have never been at the rates that are charged here, how do they get away with it, it is not as if you get shiny posh brochures these days, everything is online, there can be no justification for this, so my next question is Can you report these high fees to an ombudsman, or do we just suck it up like zillions of others, if I was younger and more computer literate I would do it my self, but alas like most of us because of the hassle and language factor must put ourselves at the mercy of the rip off merchants.

A: I know it is outrageous what some agents charge. There even are agents that charge commission from both buyer and seller. The problem is that the profession of estate agent is not regulated in Spain and everybody with as little as a mobile phone can call himself an estate agent. However, many agents do a good job, but because of the fierce competition in the field and the long time it takes to sell a house in Spain (on average 10 months) agents are sometimes forced to charge these high commissions to prevent going out of business. Nevertheless, it feels indeed very injust compared to the fees in the UK.

On the positive side, a proper agent will give you an invoice for selling your property, which you can use to deduct from your capital gains tax, but in your specific case, you do not have to pay CGT since you already meet the exception criteria.

There is no ombudsman to report these high fees sadly enough.

Q: We bought our home in 1999 and now having reached late 60`s and mid 70`s wish to move further south to be closer to our son, what taxes have we to pay if buying another property

A: When buying a new home, it very much depends on your situation and the region in Spain you are going to buy in. Hopefully, you both have your primary residence set in Spain for more than 3 years, since then you would be exempted from paying capital gains tax. When buying another property in Spain, you will have to pay your regular buying taxes as explained in this article. As a general rule of thumb, you will more or less end up paying 12% on top of the price you paid. So let’s say you bought the house for 200.000 euros, then in total, you will end up paying around 224.000 euros.

Q: I am selling a property in Spain. I inherited it from my brother who died. All taxes were paid to both the British and Spanish authorities. I am selling the house and have bought a newly built property nearby. The buyer’s solicitors are asking to retain money. This is not the 3% retention for taxes my solicitor has already factored this into the accounts. I have paid all bills, taxes, and everything that needs to be done in Spain to sell a property. There is nothing that I have not done. Why is the buyer’s solicitors insisting on retaining an amount of 1900 euros? I see no reason for it. I even reduced the price to sell. Please give me your advice.

A: I do also not see clearly what other payments the buyer’s solicitors are asking. It sounds like the 1900 euros could be for the municipal Plusvalía tax, since by law it the seller that has to pay for that. The plusvalía is a tax over the increase of the value of the ground the property is on. Just to make sure ask the buyers solicitor if it’s for that. Otherwise, I see no reason why you should pay for anything else.

Q: We are residents in Lanzarote having moved here in March 2015 we bought a property in May 2017 (this is our only property). We are considering moving back to the Uk and would like to know our selling costs. We can see the costs for non-residents but not for residents! When and if we move we will be buying a property in the UK.

A: The only advantage of being a Spanish resident is that you will not have to pay the 3% Income Tax Provision for non-residents. All other taxes are the same for both residents and non-residents.

Q: Hello I had a question about the definition of being a resident in my house. I currently have NIE status and live just under 6 months a year at my house in Spain. I am 66 years of age. Would I still be exempt from Capital Gains Tax in the event of selling my property? (although have no plans to do so in the near future).

A: The period to be eligible for the GCT exception is 3 years at the minimum. Having a NIE number/pass does not automatically exempt you from paying CGT, you should also need to be registered in your Spanish municipality as a permanent resident.

Q: I purchased o house in 1997 and I’m thinking of selling. Because of the long ownership, the selling cost is much greater than the purchase price I paid. Will I have to pay the full CGT. The property is in the Malaga district.

A: You would probably need to pay a lot of plusvalía tax, besides the CGT. My advice would be to gather all official invoices you have incurred for home improvements, solicitors costs etc and even the costs and invoices form your purchase in 1997, since you can deduct all these costs from your CGT. There is, of course, the exception I mentioned in this article ” There are exceptions when the seller does not have to pay capital gains tax and that is when the sellers of the property are older than 65 and have lived there officially for at least the last 3 years.”. I do not understand your statement that the selling costs are greater than the purchase price.

Property prices in 1997 in Málaga were much lower compared to nowadays, so you should be able to make a good profit even after paying CGT, plusvalía, solicitors, agency commission, etc… Anyway, you should ask a gestoría (Spanish bookkeeper) or your solicitors to have them calculate your net profit. In the old days (more than 5 years ago) it was a common practice to buy a property with big sums of B money to avoid paying extra taxes.

Nowadays, it is almost impossible to do that since the tax office will make their calculations and buyers and sellers can get fined for selling at a low price. To reduce your CGT, you could also sell your house furnished, since furniture is taxed at a much lower rate, I think only 4%. To do that you would have to make an inventory list. So if you sell it for 800.000 euros you can allocate 50.000 euros as part of the furniture for example.

Q: I’m about to perform a second trip to Valencia to view properties and have come across an Estate Agent who wants the Buyer to pay the 3% + VAT fee. Is this normal practice as I thought it was always the Seller who pays this fee?

A: In Spain, it is the seller who pays for the commission, not the buyer.

The standard commission percentage in Spain is around 5% on the coastal regions, but it also depends on the area. Agents in the luxury segment and in places like Marbella o Mallorca can charge 6% while in other segments or areas it is lower.

It can be the case that an agent does not have many properties to offer a client and therefore might look for other partners or collaborating agents to offer the client more properties to choose from. That is normal, and in these specific cases both agents will split the commission (2.5% each for example), but again it is always the SELLER that pays the commission.

It seems the agent you contacted is trying to profit from buyer and seller, and I would have serious doubts to trust such an agent.

Q: I bought a studio apartment 9 years ago it is now worth less than when I bought it. I will be selling it this year, do I still have to pay capital gains tax if it’s worth less than my original buying price.

A: If the price in the deeds of your apartment when you bought it in 2009 is higher than the price you are selling it for now, then, in theory, you should not have to pay any capital gains tax. I say in theory because the Spanish tax office also has to believe that you are selling it for a lower price, otherwise, you can expect to receive a fine, but hopefully, I hope that does not happen.

Q: What might a solicitor in Valencia charge for selling/ and buying?

A: Most solicitors will charge around 1% to 1.5% of the selling price to carry out the sale or purchase.

Q: In 2014, I bought a 1bedroom apartment in Tenerife for 66.000 Euro. For which I paid tax on. I have recently had a demand from tax authorities for 5,500 Euros. They are saying they value my apartment at 135,000 Euros. Totally unrealistic. At best apartments in the complex are currently selling at 85,000Euros. What can I do?

A: I have written an article on this subject in the past explaining this problem in detail.

The thing is that you bought the apartment during the crisis and since then Spanish property prices have gone up, but the tax office sees that differently.

The fine you received is called in Spanish a “complementaria” and it is quite difficult to go against it without using a solicitor.

The tax office calculates the value of your apartment and takes many things into consideration. The walls are also taken to increase the m2 surface as well as a small percentage of communal grounds, such as pools, gardens, etc…

There is no guarantee that if you appeal against the tax office you will get your 5500 euros back.

Anyway, you need to prove that your apartment was sold for the actual selling price at the time you bought it. So the first thing you need to do is to go the solicitor or gestoría that handled the sale and see if they are willing to help you in this case and appeal as soon as possible. Bear in mind that a solicitor will also cost you money, probably in the region of 1500-2000 euros.

If you decide to appeal, the tax office will inspect the sale and any other sales on that complex and there might be that some apartments were sold or have been sold for 135.000 euros. If that is not the case you have a good chance getting of your money back.

Q: Do Estate agents commission include VAT (IVA) in 3% – 6% or is this extra, if so at what rate.

A: The agent’s commission is always excluding VAT (IVA) of 21%. So you have to calculate that on top.

For example:

Selling price 250.000 euros

Agents commision (5%) = 12.500 euros

+ IVA 21% = 2.635 euros

Total = 15.125 euros

Q: We sold our property 1 year ago and still waiting to get the 3% retencion money back why are the Spanish government withholding it. We have outstanding money to pay.

A: It is indeed very frustrating that the Spanish tax office takes a very long time to pay out refunds. I know firsthand that in some cases it takes up to 3 years and more. Many foreign sellers just forget about it and close their Spanish bank account and that money stays in the tax office. The frustrating part is that in most cases it is not worth it going to a solicitor for this since it is not more than 5.000-10.000 euros. To speed things up you can go to the estate agent that sold your property and/or your Spanish solicitor and see if you can find somebody else in the same situation as you, that way you can start a case together against the tax office and oblige them to payout.

But before going into any legal battles:

1) Ask your gestor/bookkeeper/solicitor or the person that arranged the sale and taxes for you the refund payment papers, in Spanish “devolución”.

2) With the “devolución” paper you can go personally to the tax office and reclaim your money back.

3) The Spanish tax office will transfer the money to your Spanish bank account. Important: If you closed your Spanish bank account you need to give a power of attorney to your solicitor so that they can reclaim the money back for you.

Q: Good Morning Robert, Your article “The costs of buying and selling a property in Spain” is very helpful, many thanks. With regard to CGT exemption for sellers over 65 my question is as follows; I am 65 in August 2018 and my wife Susan in April 2020. We each own a 50% share in our Spanish holiday home and, if we sell the property now, our profit would be around 300,000 Euros with a CGT liability of 67,760 Euros. If, when I retire I apply for Spanish Residency and live in our house for 3 years and then sell it, would my wife’s 50% of the profit at that time be CGT exempt if she does not apply for residency? I look forward to your reply

Kind Regards Stephen

A: Thank you for your question. In case your wife does not apply for Spanish residency, she will have to pay CGT over her 50%. So only you are eligible for this exception in this specific scenario.

For your wife to avoid paying CGT a smart thing can also be to reinvest the profit by purchasing another property in Spain. For example, buying a smaller or cheaper property. By reinvesting your profit you are also exempt from paying CGT.

I hope that helps.

Kind regards Robbert

Hi I have bought a property in Alicante for 45,000 euro and refurbished it at a cost of approximately 15,000 it has been valued at 85,000 and we now wish to buy a larger property we are non residents living in England do we need to pay CGT on 40k or less refurbishment costs 25k ? Also if the money goes into another property as we would like a larger one do we still need to pay CGT on the sale and also buyers tax also on the new property

Thanks in advance

Hi John,

That’s a great question. You will need to have invoices for the 15.000 euros you spent for the refurbishments, otherwise, you will not be able to deduct that from your CGT.

In case you have the invoices, then you will only have to pay CGT over (25.000 euros) 45.000+15.000= 60.000-85.000 = 25.000 euro. Also take into consideration that when selling, you can have the furniture be part of the selling price. The furniture is only taxed at 4%, which can save you considerably some money. You will only benefit from buying a new property if the property you are selling was your primary residence for the last 3 years, which I imagine it is not.

As non-residents of Spain, we wish to sell our house. However, we are not sure whether or not we are liable for the 19% capital gains as we were recently told by 2 estate agents that that figure would only be due if we were Spanish residents. We are going for residencia in October but don’t know if we would be better off selling our house as residents or non-residents. Please advise. Thanks.

Dear Sue,

You are only exempted from paying Capital Gains if you are over 65 and if the house in Spain you are selling has been your primary residence for the last 3 years.

I imagine that is not your case and I am afraid that you will have to pay Capital Gains.

Good luck with the sale. Hopefully, you can get a good price for it. Make sure you have it appraised by a reputable company before selling it at a bottom price and be wary of dodgy estate agents.

If you need a professional to sell your house, please let me know and I will be happy to provide you with a reputable company that can help you.

Kind regards,

Robbert

Hello Mr. Dekker.

My parents live in Iceland, but bought a vacation home in Los Alcazares in 2008 from an Icelandic partnership. The houses were two in the partnership, but my parents bought one of the houses. the other owner is registered as the owner of the partnership which is registered in Iceland. I need to know if my parents are registered as the owner of the house in Spain. How or where do I find out about that?

Thank you in advance.

Dear Johann,

To view the owners of the property, you have to go to the property registry of the municipality where the property is located. Alternatively, you can search online for a registry extract on the registradores.org site. Go directly to the registry extract page. To extract the information it will cost you around 10 euros.

Hope that helps

Hello Mr. Dekker.

Thank you very much for the quick replay to my inquire.

Best regards,

Johann G.

Q. Dear Mr. Dekker,

I am a non-resident with a flat to sell in Spain. Is it possible to reduce the CGT by selling my flat furnished ? To do that would I have to make an inventory list?

Many thanks for your help.

Dear Richard,

Yes, I believe you can reduce the amount of CGT if you allocate part of the selling price as furniture. Furniture is taxed much lower, I think only 4%, but that was some time ago. I am not sure what the exact % is at the moment.

You have to indeed make an inventory list and give a value to those items.

Kind regards,

Robbert

Hi,

I’m glad I ran into your website. Lots of great information. My wife is from Valencia, I’m from the US and we live in California. In 2001 we bought an apartment in Valencia for a little over 8 million pesetas (50,000 euros), that we have enjoyed for many summer, and now we are looking to sell for hopefully 112,000 euros. From what I read in your comments to various readers is that we would be on the hook for 23% of 62,000 (that’s 14260) plus the Pluvalia of ?%. Plus any lawyer fees. Since we found our own buyer, we will not be using a real estate agent. Would the 23% for CGT be calculated after we pay the plusvalia? What do you mean by Solicitor? What is a Solicitor? Would it better to hire someone to help fill out the contract or whatever title paperwork needed for this?

Dear Hector,

You are more or less right with your calculations. The plusvalía municipal is the tax of the incremental value of the grounds of the property. If you go to the town hall of the municipality you can have them calculate it for you. Normally you pay a maximum of 20 years plusvalía. Since you bought it in the peseta time, I guess you will have to pay the maximum amount of 20 years. A solicitor is just a lawyer in UK English. Of course, you do not need one if you can manage to do the paperwork yourself.

I can also refer you to someone should you not want to do it yourself.

I would also like to warn you that selling a property under market value can result in paying an extra penalty/fine, this fine is called “complementaria” .I have encountered this fine in 50% of all sales during my real estate career. There are ways to avoid this fine, but I just want to make you aware of that, since it might set you back another 2000 euros.

Kind regards,

Robbert